Overview

For customers that have credit terms it is good practice to set a credit limit. The credit limit is the maximum accounts receivable balance allowed for a particular customer. How the credit limit is determined is different for each company. To ensure that no one changes the credit limit without authorization, use Roles and add an Exception for Credit Limit.

Where do the numbers come from when checking credit limits in Order Time?

Credit Limit: This can be manually set on a customer by customer basis.

Accounts Receivable (Balance): The A/R balance can either come from the current balance the customer is showing in the accounting system (QuickBooks, Xero, etc..) or from the A/R balance as reported by Order Time.

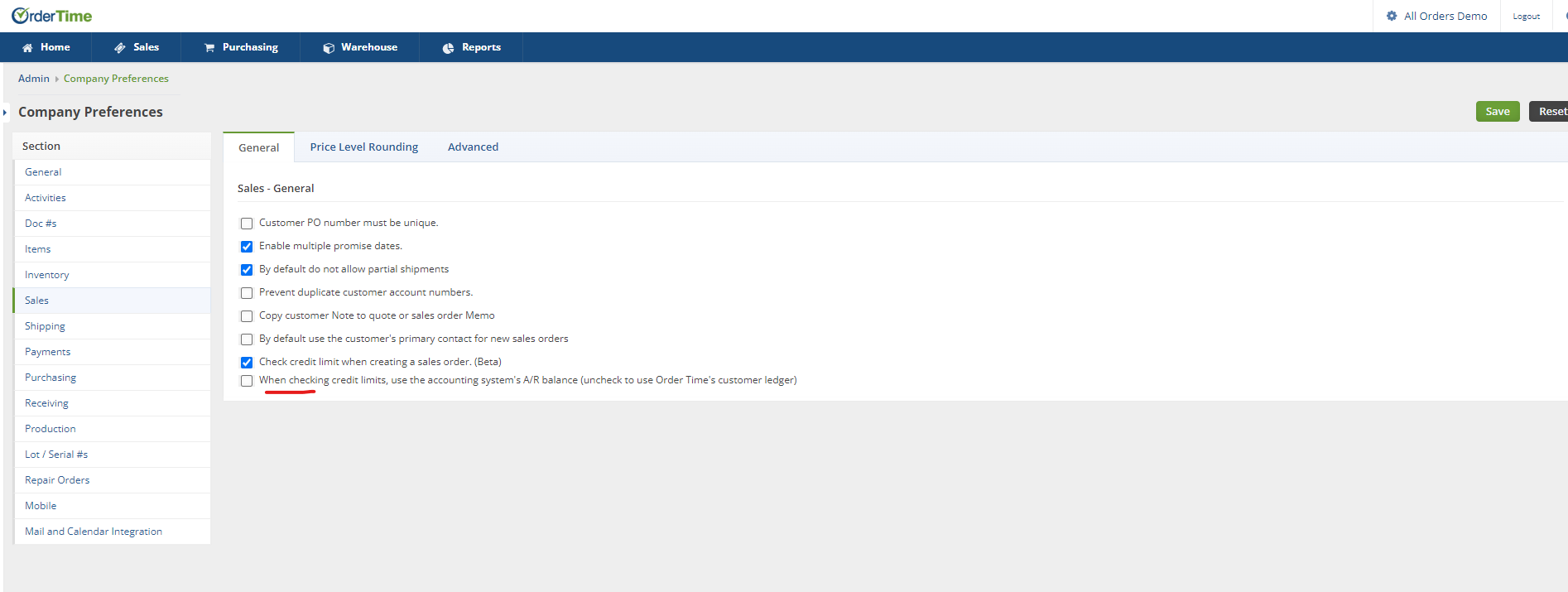

This setting can be changed by going to the Admin >> Company Preferences >> Sales >> General tab and toggling the checkmark labeled:

"When checking credit limits, use the accounting system's A/R balance (uncheck to use Order Time's customer ledger)"

A/R Balance by the accounting system:

The system will display the A/R balance based on the accounting but two additional factors will come into play, Ship Docs and payments that are not yet synced into the accounting system. Those transactions need to be factored into the balance as reported by the accounting system because they have not yet been posted there. However, they will impact the customers overall balance. Ship docs will be added to the balance while payments will be deducted.

- By Order Time: The total sum of the balances of all ship docs for the customer. Any ship docs that are not fully paid for and have open balances will be included in this calculation.

- Approved Sales Orders: The total amount of open line items on approved sales orders. The taxes/freight/discount will be factored into this number based on the percentage the open line items make up of the entire order.

Orders that are not yet approved or have been closed/voided and any line items that have been cleared/closed will not be included in this calculation. This amount will show as a negative against the credit limit.

- Credit Available: The credit limit minus what the customer has on the A/R Balance

- (if the customer happens to have a positive balance through having something such as a credit on file, then this will be a positive number) and minus what is on approved sales orders will be the credit available.