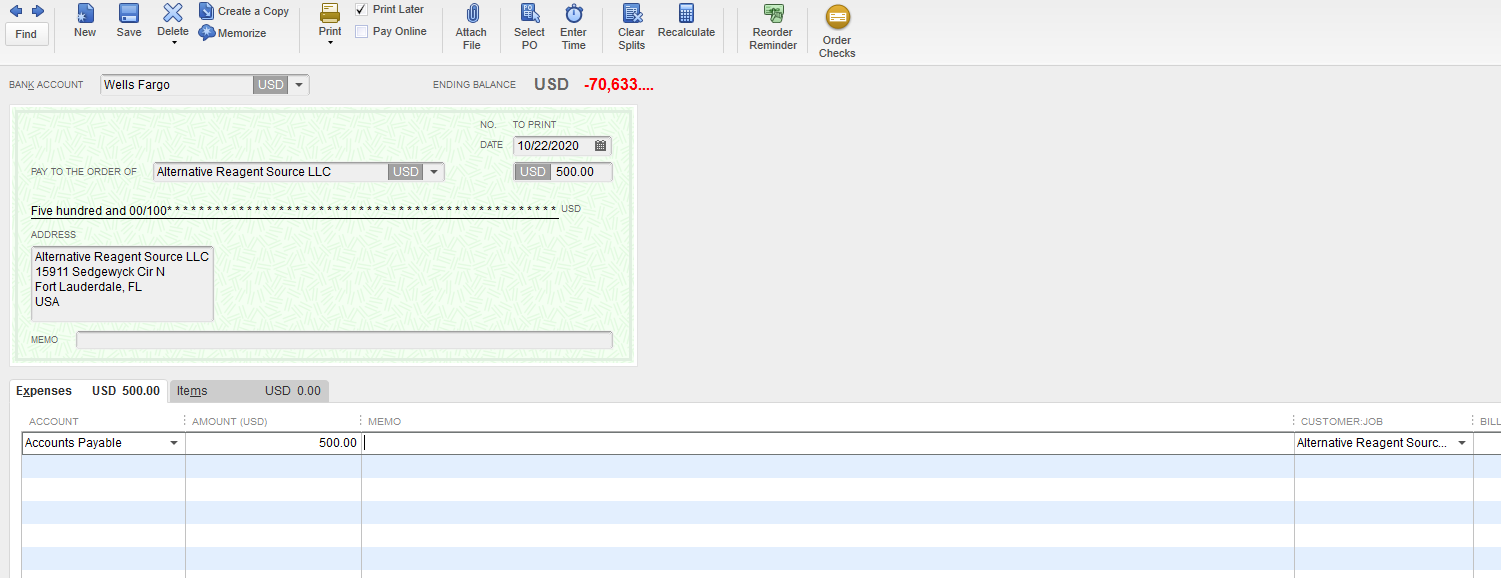

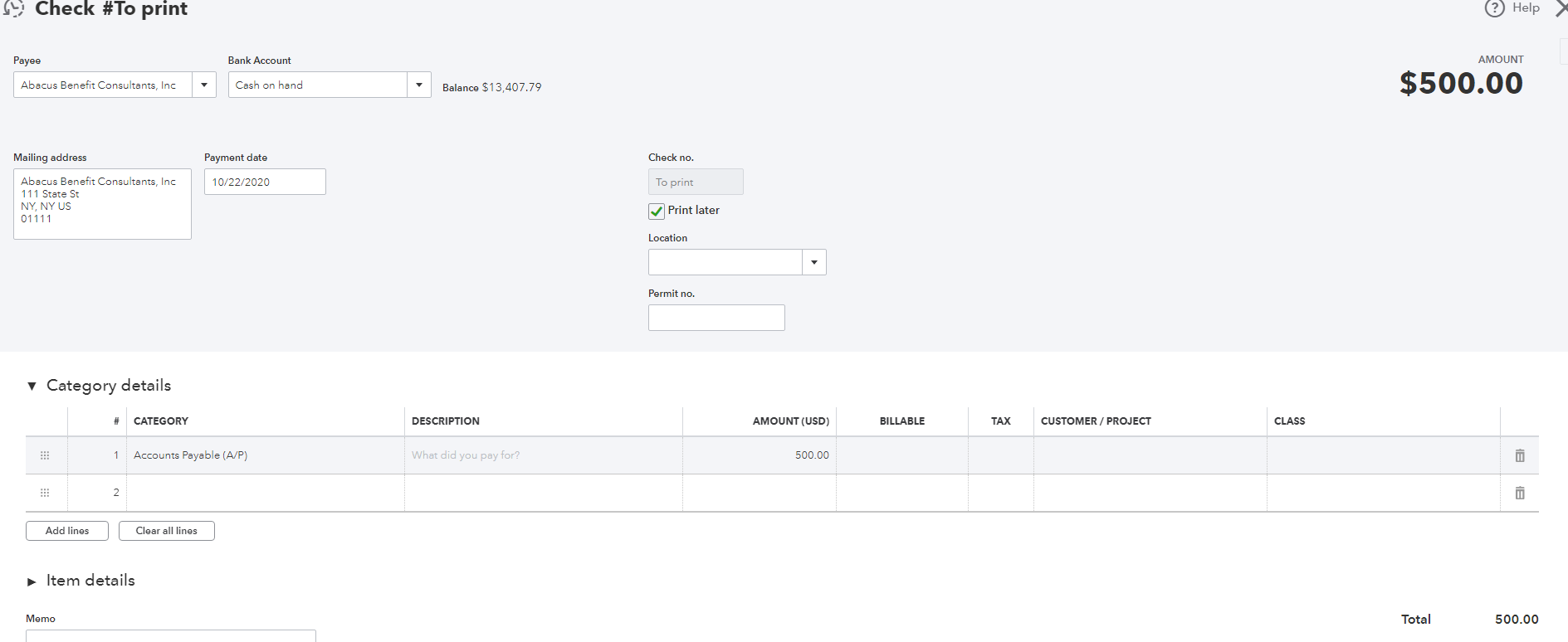

Today many companies purchase inventory with credit cards or pre-pay inventory with a check or bank transfer. In QuickBooks this is generally done by posting the a credit card charge, expense or check transaction. In the transaction, you select a Vendor and the items you are buying which will debit inventory and credit the credit card liability or bank account. Now in Order Time when you receive a purchase order it will create a bill in QuickBooks. Again in this transactions, a Vendor and the items you are buying are indicated. When recorded, this transaction will debit inventory and credit the accounts payable liability account. You can see that the Items have been recorded twice. The solution to this dilemma is straight forward; In the credit card or check transaction, instead of selecting the Items, select Accounts and enter Accounts Payable along with the name of the vendor. Now the credit card/check transaction you entered will offset the bill from Order Time resulting in zero being owed to the vendor.

-

-

- Quick Start Guide

- Onboarding Checklist

- Planning to Go Live

- Billing and Subscription

- How to Subscribe to Order Time and Purchase Additional Services

- Adding Users and Assigning Roles

- Setting Up User Roles

- Setting Up Document Statuses

- Order Time - Exporting Lists

- Class

- Items in Order Time

- Utilizing Item Aliases

- Lists

- Locations

- Currencies

- Types of Price Levels

- Adding Price Levels

- Adding Vendor Price Levels

- Import Your Opening Inventory - Ultimate Guide

- Import - Overview

- Import Fields

- Preparing the Import File

- Batch Action

- Overview - Page Layouts

- Details Page - Page Layouts

- Editor - Page Layouts

- Custom Messages

- Language and Time Settings

- Order Time Security & Backups

- System requirements for Order Time Inventory

- Advanced Security Features

- Custom List Views

- Custom Fields & Calculated Fields

- Setting Up Ecommerce Integration

- Setting Up Alerts

- EDI with Order Time

- Purchasing Remote Training Hours

- Global Search

- Limit Permission to Approve Records and Alert Approver

- Save Import files in MS DOS CSVs

- Custom Code, Integrations, and Custom Automation Rules (CAR)

- Testing Sandbox Accounts

-

-

- Sales Cycle

- Adding Leads

- Adding Customers

- Tracking Number on Ship Docs

- Creating a Quote

- Vendor RFQ - Request for Quote

- Removing Quantity from a Ship Doc

- Create a Sales Order

- Enable Catalog Ordering

- Item Substitution on a Sales Order

- Sales Order Allocation

- Select Items to Ship

- Splitting a Sales Order

- Consignment

- Additional Fees

- Issue a Customer Refund as a Credit

- Credit Limits Explained

- Creating a Transfer from a Sales Order

- Shipping Estimation

- Ship Docs Overview

- Closing a PO or SO with an Open Quantity

- Auto Email Customers on Shipping

- Merging Customers

- Closing Open Orders

- Customer Returns

- Recalculate Pricing on Sales Order

- Creating Refunds and Partial Refunds

- Putting a Customer On Hold

- Assigning Sales Rep to Customer by Address

- Default Forms for Customers

- Fulfillment Batch

- Closing a Sales Order

- Duplicating a Sales Order

- See Can Make for Assemblies and Kits on Sales Orders

- Adding a Discount as a Line Item

-

-

- Company Info

- Company Preferences Overview

- General Preferences

- General Preferences - Period Closing Date

- Company Preferences - Activities

- Company Preferences - Doc #s

- Company Preferences - Inventory

- Company Preferences - Items

- Company Preferences - Payments

- Company Preferences - Lot Numbers & Serial Numbers

- Company Preferences - Production

- Company Preferences - Purchasing

- Company Preferences - Receiving

- Company Preferences - Sales

- Company Preferences - Shipping

- Company Preferences - Repair Orders

- Company Preferences - Mobile

- Company Preferences - Mail and Calendar Integration

-

- Payments Overview

- Setting Up a Payment Gateway

- Payment Gateway - Order Time Pay

- Payment Gateway - Authorize.Net

- Payment Gateway - Intuit QuickBooks Payments

- Payment Gateway - Payflow Pro

- Payment Gateway - BluePay

- Payment Gateway - Payeezy

- Payment Gateway - USAePay

- Payment Gateway - Stripe

- Payment Gateway - Braintree

- Sending Payment Requests & Using the Payment List

- Configuring ACH Payment Requests in the Email Template

- How are payments on sales orders reflected in QuickBooks

- Order Time and Card Readers

-

- Accounting Integration Settings

- Accounting Integration Restrictions

-

-

- Production Cycle

- Kit vs Assembly Items

- Assemblies and Creating a Bill of Materials

- Create a Bill of Materials: In Depth

- Creating a Configurable Bill of Materials

- Generate a Work Order

- Tracking Work Orders

- Creating a Sales Order with a Linked PO & Linked WO

- Using Quick Build for Work Orders from a Sales Order

- Creating Work Orders for Multiple Sales Orders

- Creating a New Disassembly

- Enable Split, Drill Down, Flatten Features on a Work Order

- Drill Down a Work Order

- Splitting a Work Order

- Work Orders - Reload BOM

- How to Create Production Orders

- Quick BOM Report

- Creating a Reorder Analysis for Production

- Handling the Costs of Goods Sold account. How certain conditions may impact behavior and WO components

-

- Purchasing Cycle

- Vendors

- Creating a Purchase Order

- How can I enter my purchasing costs for my items in foreign currencies?

- Linked POs and Drop Ship POs

- Using Reorder Analysis

- Creating a Reorder Analysis for Purchasing

- Create a Receiving Doc

- Import Lot & Serial Numbers Onto Receiver Line Items

- Vendor Returns

- Receiver Charges

- Adding Charges After Receiving

- Add Items From Open Purchase Orders

- Standard Cost Vs. Value Amount

- Receiver Allocation

-

-

- Order Time Mobile - Overview & Download Link

- Order Time Mobile - Release Notes

- Order Time Mobile - Compatible Hardware List

- Order Time Mobile - Turning Off Auto-Updates

- Order Time Mobile - [VIDEO] Overview and Preferences

- Order Time Mobile - [VIDEO] Sales Orders & Picking

- Order Time Mobile - [VIDEO] Ship Docs & Packing

- Order Time Mobile - [VIDEO] Receiving Purchase Orders

- Order Time Mobile - [VIDEO] Creating a Bin Move

- Order Time Mobile - Managing Work Orders

- Order Time Mobile - Releasing Sales Orders

-

- B2B Portal Guide

- B2B - Adding a Portal

- B2B - Configuring the Portal Settings

- B2B - Setting up Item Categories & Customer Categories

- B2B - Setting up Contacts with Portal Access

- B2B - Setting up Payments for the B2B Portal

- B2B - Cart List

- B2B - Setting up Related Items for the 'Frequently Bought With' Section

- B2B - Image Sizing Guidelines

- B2B Cart import

- B2B - Emails and Logs

-

- Accounting Sync Job

- Accounting Sync Queue

- Accounting - Batch Repost Journal Entries

-

-

- Webinar - Deep Dive Q&A

- Webinar - Your Most-Requested Reports: Step-by-Step

- Webinar - Tariffs & Cost Control

- Webinar - New Version 1.0.38 Features + Q&A

- Easy Insight Integration Webinar

- Webinar - New Version 1.0.34 Features + Q&A

- Webinar - Order Time Mobile Updates

- Webinar - New Version 1.0.33 Features + Q&A

- Webinar - New Version 1.0.32 Features + Q&A

- Webinar - Release 1.0.31 Features + Q&A

- Webinar - Repair Orders + Q&A

- Webinar - Sales Order Allocation + Q&A

- Webinar - Customizing Reports in Order Time

- Webinar - Order Time Mobile App, Newest Updates

- Webinar - Newest Features From Release 1.0.30

- Webinar - Tips for a Strong Sales Cycle

- Webinar - Customer & Vendor Returns

- Webinar - Performing a Production Disassembly

- Webinar - QuickBooks Desktop or QuickBooks Online, Which Should I Use?

- Webinar - Important Reports for the New Year

- Webinar - New Features in Version 1.0.29 + Open Q&A

- Webinar - Ace Cloud Hosting and NumberCruncher

- Special Edition Webinar - Year End Inventory Planning with Alyson Distel

- Webinar - Lot & Serial Number Features - Traceability

- Webinar - Benefits of Migrating from All Orders to Order Time

- Special Edition Webinar - Make to Order vs. Make to Stock Manufacturing

- Webinar - Order Time Mobile App - New Features / Receiving

- Special Edition Webinar - Order Time - FreightPrint Integration

- Webinar - Order Time Version 1.0.28 + B2B Portal 1.1 - What's New?

- Webinar - CRM Features Walkthrough

- Webinar - Learn More About Barcoding

- Webinar - Reorder Analysis for Production

- Webinar - Advanced Features of Production

- Webinar - B2B Portal New Features + Open Q&A

- Webinar - New Features in Version 1.0.27 + Open Q&A

- Webinar - B2B Portal

- Webinar - Label Creation and Barcodes - Tips and Tricks

- Webinar - Inventory Locations & Bins

- Webinar - Inventory Counts for the New Year

- Webinar - Inventory Status Reports

- Webinar - Setting Up Sales Tax

- Webinar - Adding Price Levels & Discounts

- Webinar - Label Printing, Barcodes, & Templates

- Webinar - Payments Overview & Sending Payment Requests

- Webinar - Assemblies, Bill of Materials & Work Orders

- Webinar - Custom & Calculated Fields

- Webinar - Detail Reports

-

- Training - Creating a Disassembly

- Training - Importing an Item

- Video - Using Multiple Units of Measure

- Video - Importing Bill of Materials

- Video - Updating the Items List with Imports

- Video - Lot & Serial Number Tracking Demo

- Video - QuickBooks Online: Connecting & Syncing

- Video - Create Payment Requests & Add Payments

- Video - Purchasing, Receiving & Selling Inventory

- Video - Sending Emails From Order Time

- Video - Creating Email Templates

- Video - How to Set Up Approval Alerts

- Video - How to Control Order Approval

- Video - Prevent Auto-Fill Quantity on Ship Doc

- Video - Preventing Sync on a Document

- Video - Order Time Importing

- Video - Viewing Existing Reports

- Video - Getting Started with Order Time

-

-

-

- Feature Road Map

- Version 1.0.39

- Version 1.0.38

- Version 1.0.37

- Version 1.0.36a

- Version 1.0.35a

- Version 1.0.34b

- Version 1.0.34

- Version 1.0.33

- Version 1.0.32

- Version 1.0.31

- Version 1.0.30

- Version 1.0.29

- B2B Version 1.1

- Version 1.0.28

- Version 1.0.27

- Version 1.0.26

- Version 1.0.25

- Version 1.0.24

- Version 1.0.23

- Version 1.0.22

- Version 1.0.21

- Version 1.0.20

- Version 1.0.18

- Version 1.0.15

-

- Create Support Login

- View your Ticket Dashboard - Order Time Inventory has given you access to the Customer Portal

- How to Clear Order Time Site Cookies

- 500 Server Error - Your request cannot be processed due to a critical error. Please contact support.

- RESET GMAIL CONNECTION

- Google Authenticator - New Two-Factor Authentication

- Stop Email Delivery Issues: Verify Your Domain

- QuickBooks Payments: No Access Token Error

- [Action required] Apps on your Shopify store require updating before January 2, 2024

- Outlook 365 Integration: Whitelist the Order Time Domain

- Inventory Values are not immediately being updated (Not Recorded in LEDGER)

- Error When Viewing Customer - Rentals Tab - This feature is not enabled

- Service Items on Work Orders

- Missing Components on Bills of Material

- Why Some Line Items Have a $0 Value - Zero Value Inventory

- Creating an Invoice of your Order Time Subscription

- Storage Limits Within Order Time

- Edit Custom Fields on Closed Documents

- B2B Portal - Object Reference Error

- Why is My Company Information Changing Each Time I Sync?

- Excel Converted Number to Scientific Notation

- Summing up the Standard Cost of Components within a Bill of Materials

- Session Expired - Resolving Session Expiry in your Browser

- Excel File Splitting Solution - Splitting an Excel Sheet Into Multiple Files

- Order Time - Revision Numbers and Documents

- Why are charts not updating?

- Error sorting lists

- I have uploaded a new company logo, but it does not show on the form template

- Why can't I add customer types in Order Time?

- After changing Purchase As UOMs for an item, the cost in the BOM is not correct

- Feature Requests

- How to Perform a Hard Reload and Clear Cache

- Make sure your new Custom Field shows up on your Orders

- Improve Detail Load Time - Lag Issues

- The name of my company changed and my items temporarily disappeared

- Trouble with Auto Generate for Lot / Serial Numbers

- Cycle Count Quantities

- Order Time Mobile - Item Was Not Found Error

- How to get the BoM Step IDs for Importing BoM Components

- Exporting a CSV and Opening in Excel is Removing Trailing Zeros

- Payment Error: Do Not Honor

- My Count Timed Out and Adjustment Did Not Close

- Closing a Sales Order that has a Kit

- Item Proxies and Accounts

- Ship address street showing before Company / Name

- Printing Forms in Landscape Mode

- Enabling & Adding Foreign Currency

- Log In Error: xFi Advanced Security for Comcast

- Recent Email Changes - Amazon Email Services

- Nested Bill of Materials vs. Steps

- Custom Fields - Sales Order Items - Pick List

- Record Types

- Edit Customer Address

- Inventory Valuation Methods: Understanding FIFO, LIFO, and WAC

- Shopify API Update 3/31/2023

- Apps on your Shopify store require updating before April 1, 2024

- ShipStation Error

- Items Names or Numbers

- Prepaying Inventory

- Can I use Alpha Numeric characters in the Document Numbers?

- Error 500 A critical Error has occurred

- Item Editor Page Layout Error 500 - Purchasing Tab Conflicts with Kits

- Cannot see the custom field I created

- Associate Purchase Orders to Sales Orders

- How to avoid creating and paying a bill twice?

- Value cannot be null. Parameter name: value

- When running the Reorder Analysis, why is my required quantity not showing up?

- How do you remove apostrophes when you export a list or report.

- Sorting Line Items

- Tracking Production done by 3rd Party Vendor/Supplier

- Move line is no longer visible

- Logging Into Order Time Mobile - Alert. Incorrect API key or the key is deactivated

- How do I look up the Lot or Serial numbers that were used in the Assembly that I have already shipped?

- Adding Labor to a Bill of Materials

- My Credit Card was declined on the monthly subscription

- Unable to Login and/or my password is not working

- B2B Portal: Can Not See Customer Addresses

- The referenced transaction does not meet the criteria for issuing a credit.

- Please Avoid Using < and > Symbols Within Description Fields

- Navigating Character Issues in Text Boxes

- How to view sync, ecommerce or edi errors

- When is a Doc "Posted"?

- Editing Email Template Temporarily DisabledNew

-

- QuickBooks Online Validation Error: Memorized Sales Transactions

- QuickBooks Changes Payment Application

- QuickBooks Authentication Screens - No Internet Explorer 11 Support

- Inactive Data in QuickBooks and Order Time

- QBO Sync Error: How to know which Vendor/Customer/Item is causing a sync error using the Intuit ID.

- QuickBooks Online Issue: Error: You can’t create or modify a transaction with a date that comes before you started tracking quantity on hand

- Invoice Date in QuickBooks

- How to get Sales Order Numbers on QuickBooks Invoices

- The Min Quantity Must Be Less Than The Max Quantity

- QuickBooks Online: New Automated Sales Tax

- QuickBooks Error Message: Invalid Argument. The Specified Record Does Not Exist In The List

- QBO Discounts and Accounts

- Order Time and QuickBooks Have Different Inventory Values

- QuickBooks Sync Error - Ids service endpoint was not found

- QuickBooks Online Sync - Journal Entries only

- QuickBooks Error Message: Cannot Merge List Elements

- QuickBooks Payment Sync Error: Object specified in the request cannot be found

- QuickBooks Error : Parsing the provided XML Stream

- QuickBooks Error: Validation Exception was thrown. Duplicate Document Number Error

- Payment Sync Error - Amount applied is greater than payment or refund amount

- Product Class Sync Error: “Cannot use SalesOrPurchaseMod aggregate when the item is reimbursable”

- QuickBooks Online Error: Failed to disconnect, invalid authorization

- Troubleshooting QuickBooks Online Sync Errors - Max Character Length

- QuickBooks: The currency of the account must be either in home currency or the transaction currency

- The Given Object ID in the Field is Invalid

- Validation Exception was thrown. Details:Business Validation Error: Unexpected user error. ( -12476 )

- Why is my Order Time Quantity different from my QuickBooks Quantity?

- Quickbook Sync Error - An Attempt Was Made to Delete an Invoice with a Date that is on or before the Closing Date of the Company

- Validation Exception was thrown.Details:Invalid account type - QuickBooks Online

- Error - Proxy is Required

- No sub of when creating a customer

- Duplicate Entries: Managing Inactive List Items in Order Time and QuickBooks

- Exception was thrown.Details:Business Validation Error: Make sure all your transactions have a VAT rate before you save.

- Changing Item Groups - Sync Errors - The account period has closed

-

- Switching from QuickBooks Desktop to QuickBooks Online? READ THIS FIRST

- This feature is not enabled in this version of QuickBooks

- QuickBooks Desktop Syncing (Right Networks)

- QuickBooks Connector Error - Service Unavailable

- Attention: QuickBooks Desktop Update Issue

- QuickBooks Desktop Sync Error - Transaction amount must be positive

- QuickBooks Desktop Sync Issue - Connector is StuckNew

- Object "XXXXX-XXXXXXXXXX" specified in the request cannot be found.

- Customer has an overdue transaction

- QuickBooks Desktop Sync - Unable to continue, the current company file is unexpected

- QuickBooks Desktop Sync Tool - This application has not accessed this QuickBooks company data file before

- Required Element not found in QuickBooks

- The ticket parameter is invalid

- This feature is not enabled or not available in this version of QuickBooks

-

-

-

-

-

-

- Order Time BillingUpdated

- Importing - Adjustment Line Item

- Domain Verification vs Mail Integration

- Importing - Assembly Item

- Importing Tips

- Importing - Barcodes

- Importing - Bin

- Importing - Bin Quantity Import

- Importing - BOM Component

- Importing - BOM EASY

- Importing - Non Inventory Items

- Importing - BOM Step

- Importing - Cart Item

- Importing - Category

- Inventory AgingNew

Related Articles

Thank you for your feedback!

Thank you! Your comment has been submitted for approval.

Copyright © 2017 - 2021 Order Time is a product of NumberCruncher.com, Inc.. All rights reserved.