Overview

Sales tax codes are used to determine whether an item and/or a customer is taxable.

If you integrate with QuickBooks Online, you cannot modify the item sales tax or tax codes in Order Time inventory. QuickBooks Online does not have an API for 3rd party apps to manages those lists. Users can only manage them from within QuickBooks Online itself.

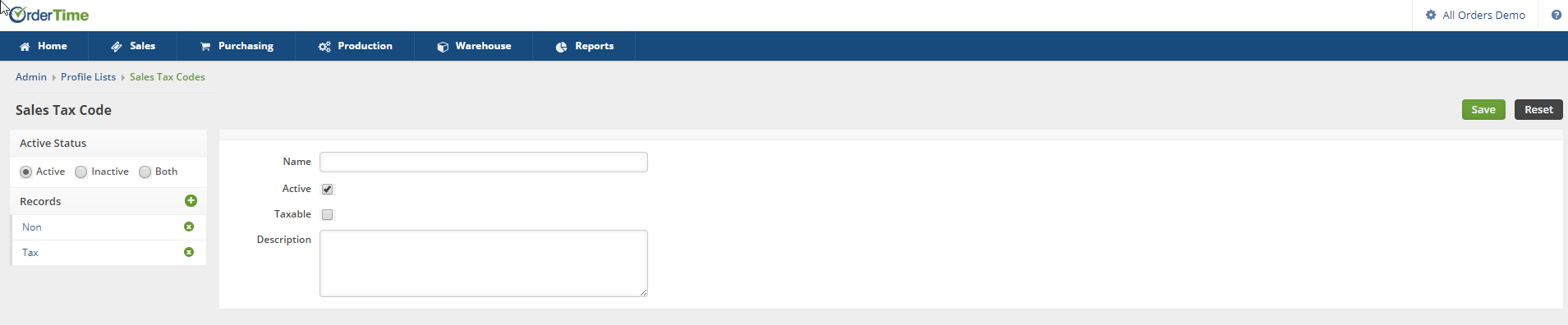

Enter Sales Tax Codes

Enter the Tax Name, select if the Sales Tax Code is Active, select if the Sales Tax Code is Taxable and enter a Description for the Tax Code. To access the Sales Tax Codes setting click on the Gear icon on the top right of the screen, under General category, Click on Profile List. Under the Sale category click on Sales Tax Codes.

- If an item or customer is taxable (i.e. when "Taxable" is selected.), then the software will use the item's Sales Tax Rate to determine the tax on Quotes, Sales Orders and Ship Docs.

- The Customer's sales tax code Overrides an item's sales tax code. For example, if an item is generally taxable but the customer is non-taxable, there will be NO tax charged.